EigenLayer: What do we know so far?

Exploring the underlying mechanics, the economics of the marketplace, as well as insights derived from the testing phase to date.

Introduction

EigenLayer is increasingly becoming a focal point within the Ethereum ecosystem, epitomising the re-staking phenomenon that has garnered significant interest among crypto enthusiasts.

The company has successfully secured funding through three rounds, beginning with an initial seed round in August 2022, followed by two additional rounds. Collectively, investors have contributed $164.5 million to the project, with the most recent round raising $100 million from the prestigious Silicon Valley venture fund, Andreesen Horowitz.

Since it began accepting deposits in June 2023, EigenLayer has implemented a phased strategy for user fund integration, initially placing limitations on the types and amounts of Liquid Staking Tokens (LST) that could be deposited. These restrictions have since been removed, allowing users to deposit twelve different types of LST and Ether staked directly by validators.

Operator testing started in the fourth quarter of 2023, primarily focusing on the rigorous evaluation of EigenDA, a data availability layer built on EigenLayer, intended to provide scalable, secure and decentralised transaction storage for roll-ups. These tests were executed on the Goerli testnet and, more recently, on the Holesky testnet.

Earlier this month, the company introduced the first mainnet iteration of EigenDA, aimed at enhancing roll-ups built on EigenLayer. This deployment is supported by numerous operators on the mainnet and is committed to providing secure and scalable transaction storage for roll-ups within the ecosystem.

In the context of Layer 2 (L2) solutions, side chains, and app chains, the primary objective is to lower transaction costs for end users. This reduction is achieved significantly by L2s, which aggregate transactions and selectively utilise Layer 1 (L1) for data availability.

Following the latest update to Ethereum, raw transactions from L2s are stored in blob space on L1 for approximately 18 days — sufficient time for challenges to optimistic transactions. This storage method reduces costs for L2s, but EigenDA goes further by retaining transactions within its own layer and only posting signatures to L1, thereby minimising the data availability requirements on L1 while still ensuring the integrity of stored data.

Moreover, by minimising storage on L1 and reutilizing ETH validator capital, EigenLayer & EigenDA substantially reduce the costs associated with launching an independent chain and helps prevent the fragmentation of economic value.

EigenLayer positions itself as providing "Shared Security to Hyperscale Ethereum." This discussion explores the underlying mechanics, the economics of the marketplace, as well as insights derived from the testing phase to date.

Re-staking

Background

Understanding re-staking necessitates an appreciation of the role of LSTs in Ethereum. Following the launch of the consensus layer in the fourth quarter of 2020, various platforms emerged, providing public access to Ethereum staking returns without the need to operate a node or own the 32 ETH required for validator operation.

LSTs allow for the deposit of any amount of ETH by a user with the LST protocol issuing an ERC20 token that represents their staked amount. These deposits are collectively managed, and validators are established, relieving users from the technical complexities involved. The staking rewards are represented either by an increase in the value of these tokens in relation to ETH, or interest might accrue in the form of additional tokens (rebasing).

Any individual with ETH can start earning staking rewards by simply visiting a website and transferring ETH to a designated smart contract. This ETH can be reclaimed at any time by exchanging the tokens either through the staking website or on an exchange.

The popularity of LSTs has been significant. LIDO, a leading platform in this area, manages approximately $28.5 billion in ETH deposits. Users not only receive staking rewards—after a platform fee is deducted—but also can utilise the ERC20 tokens in liquidity pools, lending, or yield farming (DeFi).

This capability allows users to enhance their returns beyond mere staking rewards, providing additional avenues for income. EigenLayer seeks to augment this process by encouraging users to "re-stake" their LSTs and validators, and by offering a framework for developers to create additional services that utilise re-staked ETH for consensus building and economic security.

What is it?

The fundamental concept of EigenLayer is to repurpose the substantial pool of capital that secures Ethereum’s proof-of-stake network to safeguard additional chains, thereby eliminating the need for multiple trust systems and the extensive capital and infrastructure each requires.

EigenLayer functions as an infrastructure layer, comprising smart contracts that facilitate the development of services within the Ethereum ecosystem. It expands the possibilities for builders by allowing them to leverage Ethereum's economic security without dictating the specifics of project construction. This approach allows projects to utilise Ethereum's capital and staking infrastructure to kickstart innovative developments.

The platform aims to streamline the process of launching various blockchain infrastructure elements such as side chains, roll-ups, bridges, oracles, and other services. It does so through a generalised toolkit designed to provide economic security through re-use of existing validators or staked ETH as well as fast and secure data storage via EigenDA.

Imagine the challenge of developing an oracle optimised for accessing, storing, and supplying real-world data to smart contracts. Launching this as a new chain would require generating awareness, persuading people to buy into the token, convincing them to stake, and building a robust platform, all while ensuring there are sufficient incentives to maintain capital within the network. If capital were to be withdrawn, the security of the network could diminish, potentially triggering a downward spiral where declining token prices lead to reduced security, which leads to further drops in token value.

EigenLayer offers a solution for launching side chains without the necessity of gathering new capital, by enabling the reuse of existing ETH capital. Users who hold LSTs or are consensus layer validators can allocate their stakes to operators through EigenLayer smart contracts. These operators then manage Actively Validated Services (AVS) on behalf of the users to validate entirely new chains while maintaining the security standards of Ethereum.

How it works

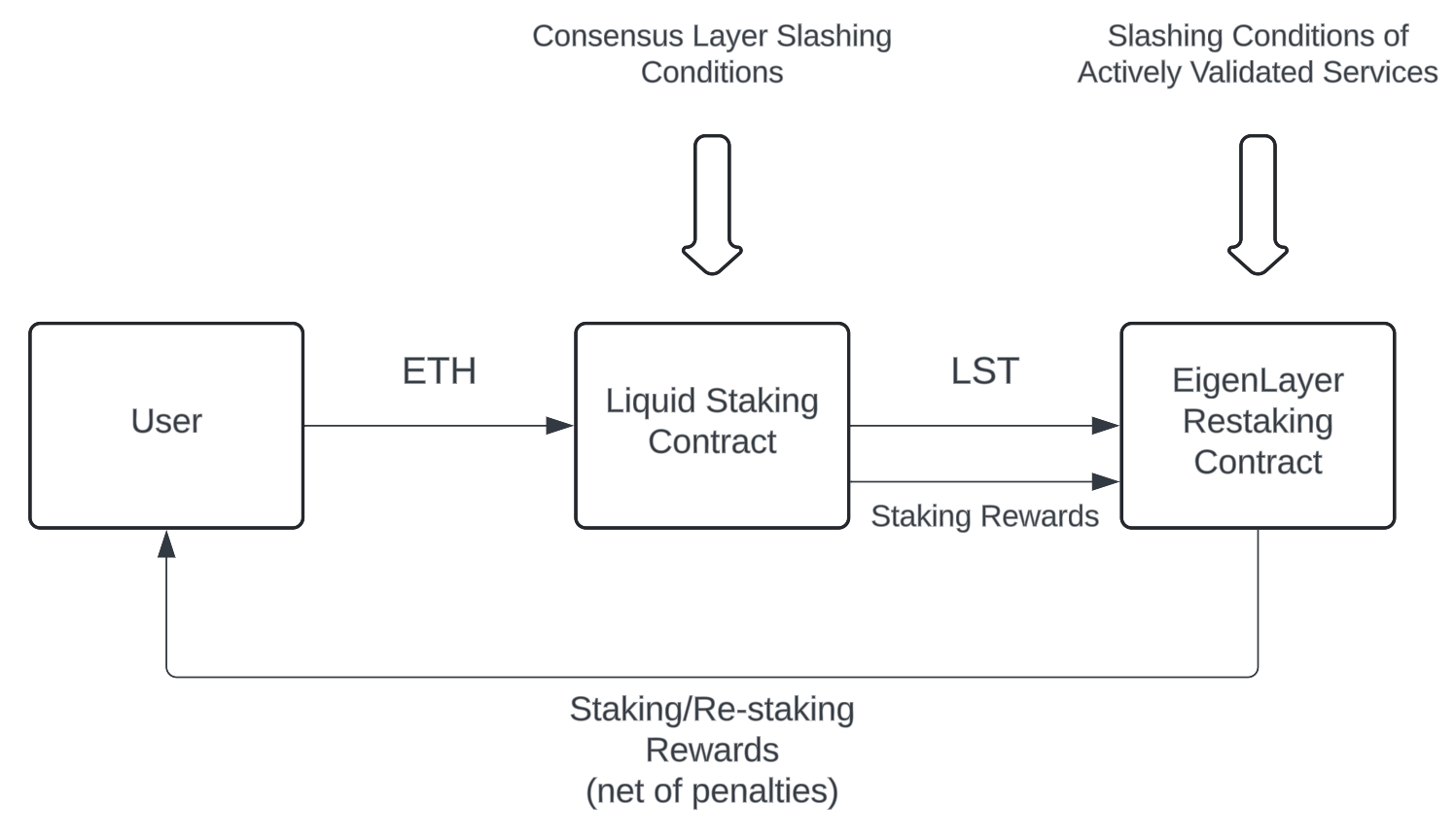

EigenLayer introduces two primary mechanisms for re-staking ETH. The first mechanism allows holders of LSTs to transfer their ERC20 tokens to an EigenLayer deposit contract, with separate contracts available for each supported type of LST. This re-staking process can be initiated through an online web interface.

Figure 1

Figure 1

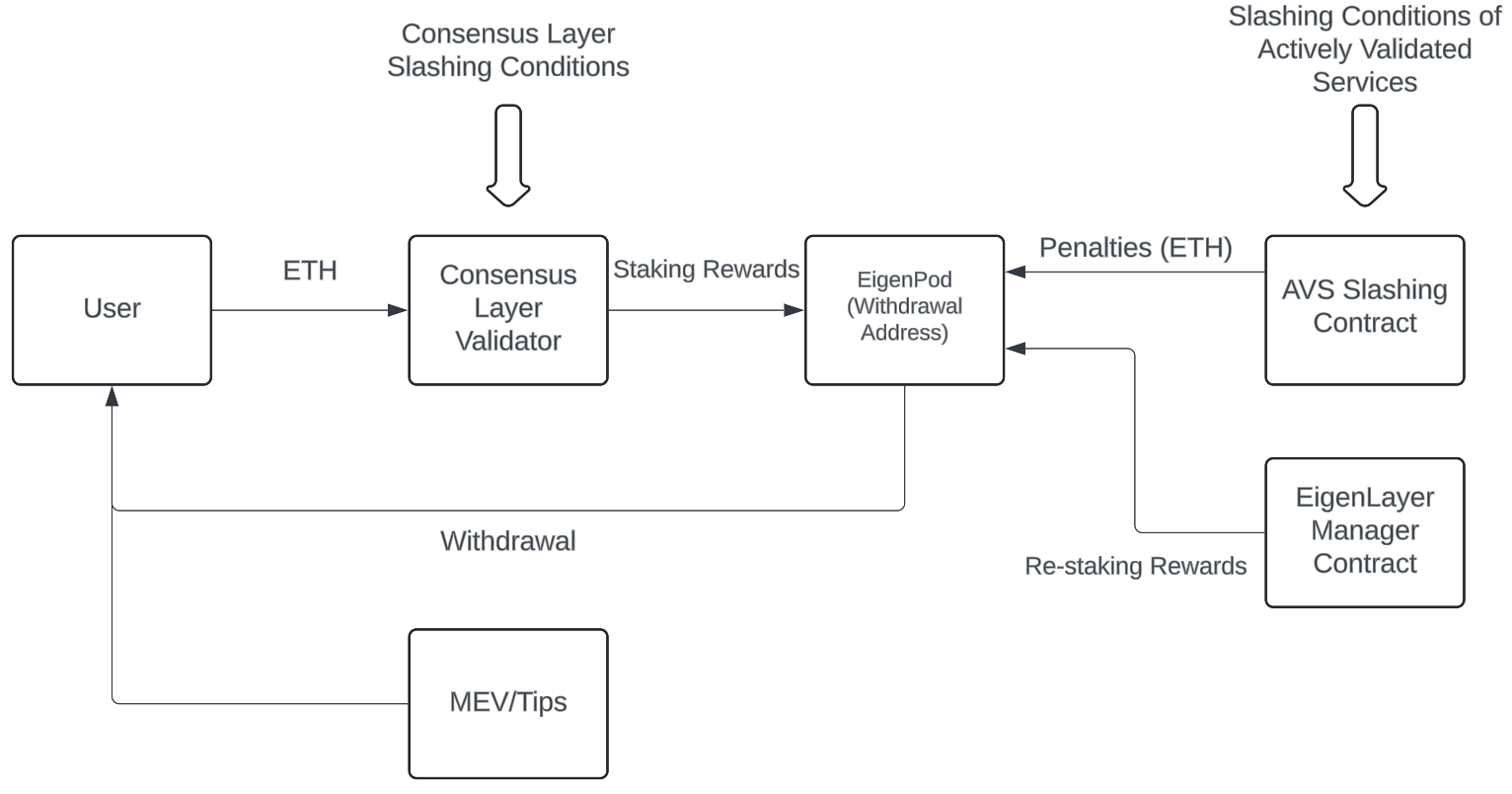

The second mechanism caters to users who possess one or more consensus layer validators. This involves setting up a new smart contract, termed an EigenPod, which is used as the validator withdrawal address. When a validator is established with its withdrawal address linked to an EigenPod, it can be dedicated to EigenLayer through the web interface.

Figure 2

Figure 2

By assigning the withdrawal address to the EigenPod and allowing this smart contract to oversee fund flows from the consensus layer, EigenLayer enforces a system that could impose additional slashing penalties in the event of operator misconduct. Rewards from the execution layer (MEV/Tips) do not flow to the EigenPod and cannot be penalised.

It is important to note that, as per the latest mainnet release, there are currently no slashing conditions implemented. This approach is projected to function in this manner in the future, although it remains uncertain whether operators will achieve the necessary levels of reliability, in the absence of incentives or penalties, to ensure the smooth operation of AVS. Six AVS launched in total as part of this release and more are in development or active on the testnet.

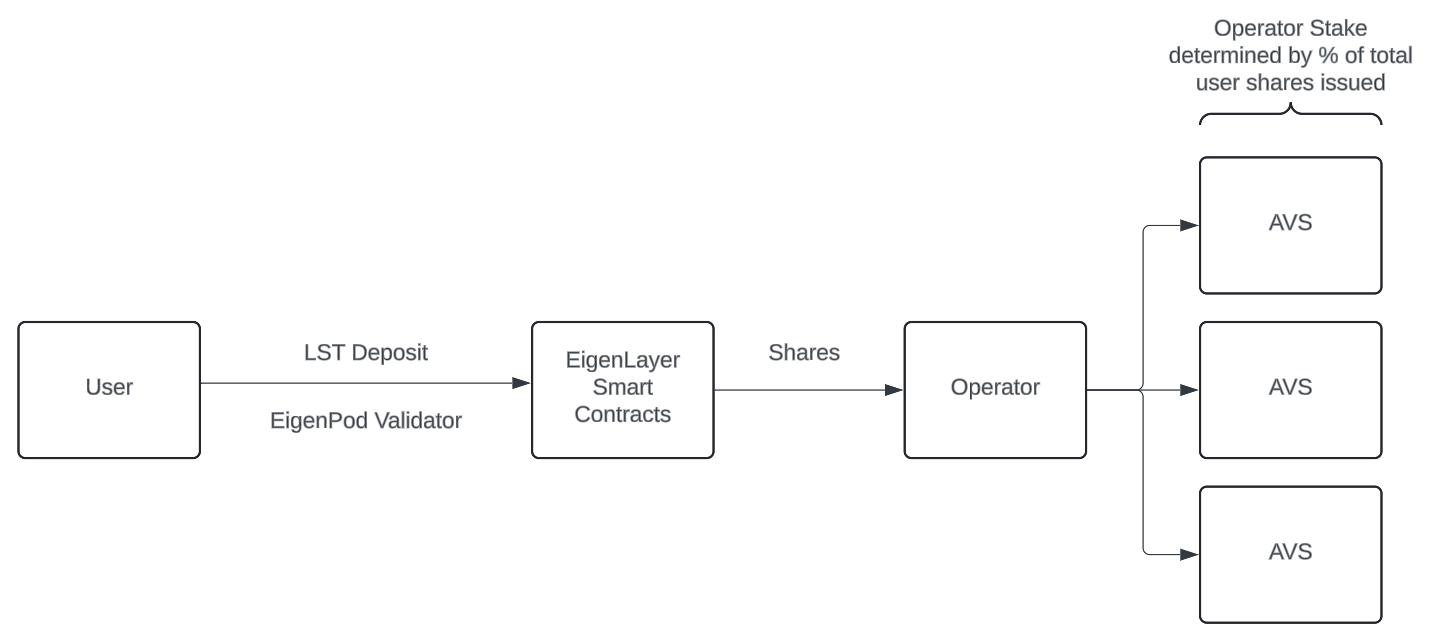

Delegation

Once LSTs are transferred to a smart contract or consensus layer validators are assigned to an EigenPod, the next step is the delegation to an operator. This process involves the internal logic of the smart contracts issuing shares to the individual re-staking, known as the restaker. Delegation requires that all shares, across all re-staked assets, be committed to a single operator. Importantly, each wallet is restricted to delegating to only one operator.

In the Ethereum ecosystem, operators manage validators on behalf of users. Within EigenLayer, these operators also run client software for each AVS they support, akin to operating a validator client for the consensus layer. Operators have the autonomy to choose the services they wish to support. The cumulative total of shares from all users delegating to a specific operator determines their stake in signing and attesting to blocks within these services. Similarly to how a user commits all their shares to a single operator, the operator commits the totality of their shares to each and every AVS they choose to support.

Figure 3

Figure 3

As users delegate their assets, the shares held by the operator increase in proportion to the total assets restaked by those users. These shares reflect the commitment level of the operator to any of the AVS to which they are dedicated, essentially quantifying the operator’s stake in validating these services.

It is important for users to choose an operator who validates a range of AVS that align with their individual interests. Operators select AVS based on their attractiveness, considering factors such as demand and potential returns, while users choose an operator based on the specific AVS they want to support and the cumulative returns on offer.

The decision-making process for operators on which AVS to support involves assessing the computational demands and costs associated with running these services against the potential rewards. Users, in turn, evaluate operators based on their expertise and efficiency in managing the AVS and the associated risk/reward profile of the services they provide. This interdependent selection process ensures that both operators and users align their goals within the EigenLayer ecosystem.

Economics

Rewards & Penalties

Currently, the reward economics of EigenLayer are primarily theoretical. Neither EigenDA nor any other AVS currently have reward or penalty mechanisms operational on either testnet or mainnet.

As it stands, operators have limited incentives to run AVS light client software on their validation infrastructure, other than the potential benefits of being early adopters on EigenLayer and attracting a user base that allocates re-staking shares to them. This involvement comes at the cost of operational expenses and promotional efforts without direct financial compensation.

Looking ahead, there is an anticipated scenario where AVS could generate fees from users or services that utilise them, with a portion of these fees being distributed to both users and operators. EigenLayer is envisioned to evolve into a marketplace for economic security, where AVS can market their offerings based on service profiles and potential income. While EigenLayer has announced intentions to introduce a fee model later this year, the specifics of this model have not yet been disclosed.

Additionally, the protocol currently lacks mechanisms to penalise operators for poor performance. In the proposed system, when users commit assets to re-staking, they agree to additional slashing conditions. In the Ethereum protocol, slashing typically occurs if operators double-sign a block. In theory, similar penalties would be applicable to operators who fail to properly execute the duties for the AVS they manage. Users who commit funds to such operators face the risk of having their funds slashed if the operator fails to correctly attest to or sign AVS blocks.

The process for depositing LSTs is relatively straightforward, as all capital is deposited into EigenLayer's smart contracts and is subject to potential penalties without constraints. However, for EigenPods, where the withdrawal addresses of validators point to an EigenLayer smart contract, EigenLayer is currently limited to penalising only the skimmed rewards, which involve the regular removal of excess balances accumulated at a validator. Any future mechanisms that might allow for the forced exit of validators to access base capital are yet to be developed.

Internal Token Economics

At this early stage, the operational details of how AVS will function remain somewhat undefined. Fundamentally, AVSs can issue their own tokens, which would be used to pay for services such as gas fees required for transactions involving the AVS.

AVSs are motivated to develop sound token models that appeal to both users and stakers. The pricing of these fees will need to be competitive with other services while still being high enough to yield a reasonable return. This balance is necessary to adequately compensate stakers and operators for their risks and the operational costs associated with running the AVS.

There are several proposed mechanisms for setting fees, and these fees for commercial services and protocols could be paid in a neutral currency like ETH or in the AVS’s own token. This latter option introduces foreign exchange risk for operators. Should AVSs need to pay in a currency other than their own token, they may have to acquire ETH by selling their tokens in the open market, which could lead to price risks if the exchange rate between the token and ETH is unfavourable.

It is crucial to note that fluctuations in the value of the AVS token should not impact the security or the cost to potentially compromise the network. The fundamental security is derived from the staked ETH, which represents a pool too large to make attacks economically viable.

Fees generated from the use of AVS by consumers will be distributed amongst, the AVS, ETH restakers, and the operators. To generate substantial income for these parties, given the amount of ETH that restakers have committed, the scale of economic activity on EigenLayer will need to be considerable.

Points

The concept of points has rapidly gained traction within the re-staking community, leading to what can be described as the full gamification of Ethereum staking. Several new staking platforms have emerged swiftly, attracting large deposits and offering automated re-staking services (eliminating the need for users to interact with multiple sites). These platforms reward users with both their own points and EigenLayer points.

Currently, points function as an off-chain accounting ledger, which means they cannot be independently checked, verified, or queried. There is an anticipation that these points may eventually be converted into tokens, according to the issuing protocols. While the specifics of this conversion process remain unclear, the prevailing sentiment on social media suggests a significant interest in such conversions, driven by speculative expectations.

The primary goal of introducing points is to promote sustained engagement on platforms, mirroring the incentives once provided by airdrops but aiming to avoid merely transient activities where users deposit funds without engaging further. In the case of EigenLayer, for instance, stakers are rewarded with one point per ETH re-staked for each hour the ETH remains re-staked.

From a regulatory perspective, this method allows projects to attract and retain users without directly promising an airdrop. Whether this approach will have a lasting impact on user engagement and platform loyalty is yet to be determined.

Liquid Restaking Tokens

The burgeoning interest in advanced staking strategies has led to a compelling query: Why merely liquid stake when one can seamlessly stake and re-stake for additional rewards? This question has swiftly been addressed by several innovative projects that have recently entered the market.

Renzo, Ether.fi, and Puffer are among the pioneers in this domain, rapidly attracting substantial ETH deposits from users. These platforms dominate the leaderboard in terms of assets committed to EigenLayer, showcasing their early success and influence.

Each platform provides a unique take on a central concept: simplifying the re-staking process for users. They eliminate the need for users to manually select an operator for delegating their re-staked assets. Instead, these platforms evaluate and collaborate with the AVS to make these decisions on behalf of users, in addition to accumulating EigenLayer points and awarding additional platform-specific points.

Theoretically, once AVS begins to distribute rewards, these benefits would be expected to enhance the value of the Liquid Restaking Token (LRT) that users receive upon depositing their Liquid LSTs into one of these platforms.

A key advantage of using LRT is that it circumvents the need to deposit LSTs directly into EigenLayer, thereby preserving the potential to further compound yields through DeFi yield farming or lending. Essentially, by depositing LSTs and receiving LRTs, users still maintain the flexibility to engage across the DeFi ecosystem on platforms that support LRTs. This model, while innovative, does introduce layers of complexity and could potentially bring about unforeseen risks as it continues to evolve. The long-term implications of this daisy chain of yield enhancement remain to be seen.

Conclusion

The evolution of Ethereum staking through the introduction of platforms like EigenLayer represents a significant shift in the decentralisation and security paradigms of blockchain technology. By facilitating the reuse of Ethereum's economic security through mechanisms such as the re-staking of LSTs and the creation of EigenPods, EigenLayer enables a more efficient utilisation of capital and resources. This model not only enhances the security of additional chains but also paves the way for innovative uses of staked capital without necessitating the accumulation of new funds. Such advancements are instrumental in creating a robust and interconnected ecosystem where economic activity can thrive on a scale previously unattainable.

However, the nascent state of reward mechanisms and the theoretical nature of many proposed features within EigenLayer suggest that while the foundational technology holds promise, much remains speculative. The future effectiveness and reliability of these mechanisms will largely depend on their ability to attract sustained user engagement and ensure equitable distribution of rewards and risks among all participants. The transition from theoretical models to practical, sustainable economic systems within EigenLayer will require careful balancing of incentives, regulatory compliance, and technological innovation.

As platforms like Renzo, Ether.fi, and Puffer continue to simplify and automate the staking and re-staking processes, they address the demand for more user-friendly blockchain interactions while potentially introducing new risks. The challenge moving forward will be to manage these risks effectively while capitalising on the opportunities for enhanced yield generation. This evolving landscape highlights the dynamic nature of blockchain technology and its potential to reshape financial systems, demanding continuous adaptation and vigilant oversight from both developers and users alike.